des moines new mexico sales tax rate

Des Moines in Iowa has a tax rate of 6 for 2022 this includes the Iowa Sales Tax Rate of 6 and Local Sales Tax Rates in Des Moines totaling 0. 700 2022 Des Moines County sales tax Exact tax amount may vary for different items Download all Iowa sales tax rates by zip code The Des Moines County Iowa sales tax is 700 consisting of 600 Iowa state sales tax and 100 Des Moines County local sales taxesThe local sales tax consists of a 100 county sales tax.

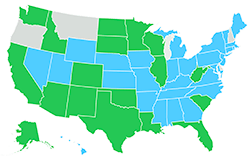

This Is The Most Expensive State In America According To Data Best Life

The 7 sales tax rate in West Des Moines consists of 6 Iowa state sales tax and 1 Polk County sales tax.

. The Des Moines sales tax rate is 7. The Washington sales tax rate is currently. Future job growth over the next ten years is predicted to be 222 which is lower than the US average of 335.

The cost of living in Des Moines is 21 lower than the national average Des Moines housing is 63 lower than the national average New Mexico general sales tax is 1 higher than the national average New Mexico state income tax is 31 lower than the national average Most Affordable Places to Live in and Around Des Moines. While many other states allow counties and other localities to collect a local option sales tax Iowa does not permit local sales taxes to be collected. The Des Moines County Sales Tax is 1 A county-wide sales tax rate of 1 is applicable to localities in Des Moines County in addition to the 105 Puerto Rico sales tax.

The Des Moines sales tax rate is. New York Salary Example for 4000000 in 2022. The West Des Moines Iowa sales tax is 600 the same as the Iowa state sales tax.

Heres how Des Moines Countys maximum sales tax rate of 7. Sales tax region name. While many other states allow counties and other localities to collect a local option sales tax New Mexico does not permit local sales taxes to be collected.

Tax Rates for Des Moines - The Sales Tax Rate for Des Moines is 61. You can print a 7 sales tax table here. The new tax went into effect on Monday July 1 2019.

The Des Moines sales tax rate is. Some cities and local governments in Des Moines County collect additional local sales taxes which can be as high as 88817841970013E-16. The Des Moines Iowa sales tax is 600 the same as the Iowa state sales tax.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Instead of the rates shown for the Des Moines tax region above the following tax rates apply to. 1000 Is this data incorrect.

Des Moines NM Sales Tax Rate. The minimum combined 2022 sales tax rate for Des Moines New Mexico is. There is no applicable city tax or special tax.

The city used 65 of the revenue from that tax to lower. The Des Moines Sales Tax is collected by the merchant on all qualifying sales made within Des Moines. Des Moines Sales Tax Rates for 2022.

Tax rates are provided by Avalara and updated monthly. There is one additional tax district that applies to some areas geographically within Des Moines. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

None of the cities or local governments within Des Moines County collect additional local sales taxes. The Des Moines Sales Tax is collected by the merchant on all qualifying sales made within Des Moines. 3 rows The Des Moines New Mexico sales tax rate of 60625 applies in the zip code 88418.

The West Des Moines Sales Tax is collected by the merchant on all qualifying sales made within West Des Moines. California Salary Calculator 2022. Real property tax on median home.

Des Moines has seen the job market decrease by -13 over the last year. The US average is 60. The County sales tax rate is.

The rate dropped more than 1 last year from 1165 to 1063 because of the 2019 passage of the Local Option Sales and Services Tax. The Des Moines County Sales Tax is 1. The current total local sales tax rate in Des Moines NM is 77500The December 2020 total local sales tax rate was also 77500.

This is the total of state county and city sales tax rates. The Des Moines New Mexico sales tax is 513 the same as the New Mexico state sales tax. The New Mexico sales tax rate is currently.

The Des Moines New Mexico sales tax rate of 60625 applies in the zip code 88418. Sales Tax State Local Sales Tax on Food. For tax rates in other cities see Iowa sales taxes by city and county.

Real property tax on median home. Look up 2021 sales tax rates for Des Montes New Mexico and surrounding areas. The County sales tax rate is.

The minimum combined 2022 sales tax rate for Des Moines Washington is. Des Moines Sales Tax. The US average is 73.

While many other states allow counties and other localities to collect a local option sales tax Iowa does not permit local sales taxes to be collected. Des Moines has seen the job market decrease by -13 over the last year. Sales Tax State Local Sales Tax on Food.

Des Moines has an unemployment rate of 43. This is the total of state county and city sales tax rates. A county-wide sales tax rate of 1 is applicable to localities in Des Moines County in addition to the 6 Iowa sales tax.

Seattle Washington S Sales Tax Rate Is 10 25

Illinois Sales Tax Rates By City County 2022

Ebay Sales Tax Everything You Need To Know Guide A2x For Amazon And Shopify Accounting Automated And Reconciled

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Sales Tax Rates In Major Cities Tax Data Tax Foundation

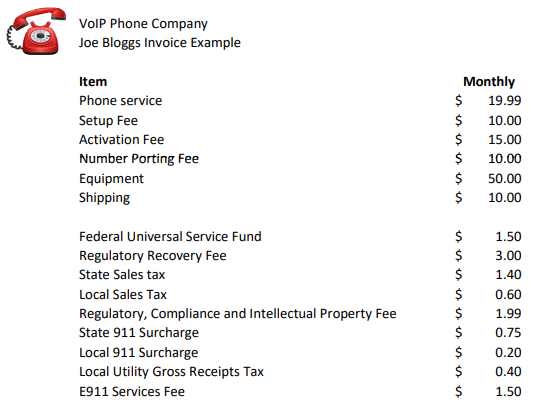

Wireless Taxes And Fees Climb Again In 2018 Tax Foundation Of Hawaii

Iowa Sales Tax Rates By City County 2022

Louisiana Sales Tax Rates By City County 2022

Amazon In Its Prime Doubles Profits Pays 0 In Federal Income Taxes Itep

Wisconsin Sales Tax Rates By City County 2022

Gross Receipts Location Code And Tax Rate Map Governments

Iowa Tax Reform Details Analysis Tax Foundation

New Mexico Sales Tax Rates By City County 2022

New Mexico Sales Tax Calculator Reverse Sales Dremployee

Gross Receipts Location Code And Tax Rate Map Governments

Sales Tax Rates In Major Cities Tax Data Tax Foundation