rhode island income tax withholding

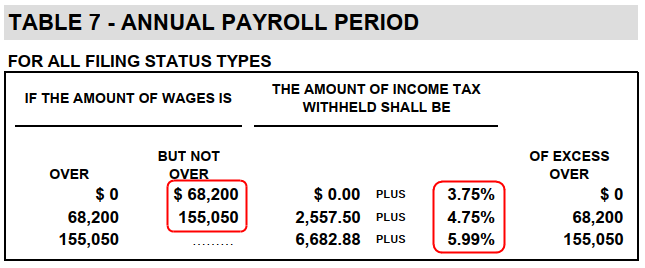

3 Even though the employees wages are NOT subject to federal income tax withholding the employer may withhold if the. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022.

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Rhode Island regulatory law provides that a Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if.

. Rhode Island issues guidance for income tax withholding on wages of employees temporarily working within and outside of the state due to COVID-19 In ADV 2020-22 the Rhode Island Department of Revenue Division of Taxation provides temporary relief from income tax withholding for employees who are temporarily working from home outside of the state where. No action on the part of the employee or the personnel office is necessary. The excise tax on liquor is 540 per gallon.

In 2013 Rhode Island repealed sales taxes on liquor and wine in order to keep prices in line with other states in the region. In that event the Rhode Island personal income tax and withholding requirements. Wages paid to Rhode Island residents who work in the state are subject to withholding.

The sales tax still applies to beer and excise taxes are still collected on all types of alcohol. Rhode Island Income Tax Withholding Certificate RI-W4 RI W-4 2022pdf UMass employees who reside in Rhode Island use the RI-W4 form to instruct. The income tax wage table has changed.

See Withholding on Residents Nonresidents and Expatriates. 1 The employees wages are subject to federal income tax withholding and 2 Any part of the wages were for services performed in Rhode Island. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed.

To have forms mailed to you please call 4015748970. The annualized wage threshold where the annual exemption amount is eliminated has changed from 234750 to 241850. Hold Rhode Island income tax from the wages of an employee if.

2 Any part of the wages were for services performed in Rhode Island. EMPLOYEES FROM WHOSE WAGES RHODE ISLAND TAXES MUST BE WITHHELDA Rhode Island employer must with- hold Rhode Island income tax from the wages of an employee if. Additionally employers in other states may wish to withhold Rhode Island personal income tax from wages of their Rhode Island employees as a convenience to those employees.

Rhode Island income tax must also be withheld from wages paid to Rhode Island nonresident employees for services performed in the state. The income tax withholding for the State of Rhode Island includes the following changes. All forms supplied by the Division of Taxation are in Adobe Acrobat PDF format.

Rhode Island employers determine withholding using federal Form. Rhode Island Alcohol Tax. EMPLOYEES FROM WHOSE WAGES RHODE ISLAND TAXES MUST BE WITHHELD.

1 The employees wages are subject to federal income tax withholding and 2 Any part of the wages were for services performed in Rhode Island. The income tax withholding for the State of Rhode Island includes the following changes. 1 The employees wages are subject to federal income tax withholding and.

Rhode Island extends COVID-19 income tax withholding guidance for teleworkers The Rhode Island Division of Taxation announced that it has extended through September 15 2021 previously extended through July 17 2021 emergency regulations that temporarily waive the requirement that employers withhold Rhode Island state income tax from the wages of. A Rhode Island employer must with-hold Rhode Island income tax from the wages of an employee if. The Amount of Rhode Island Tax Withholding Should Be.

The income tax wage table has changed. Withholding tax forms now contain a 1D barcode. 375 0.

0 65250 000. A the employees wages are subject to Federal income tax withholding and b any part of the wages were for services performed in Rhode Island 280-RICR-20-55-106C1. Rhode Island extends guidance for income tax withholding on the wages of teleworkers during the COVID-19 state of emergency The Rhode Island Division of Taxation has extended through March 19 2021 emergency regulations that temporarily waive the requirement that employers withhold Rhode Island state income tax from the wages of employees temporarily working.

65250 148350. The excise tax on wine is 140 per gallon. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum 750.

An employer may withhold Rhode Island personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding. Please use Microsoft Edge browser to get the best results when downloading a form. No action on the part of the employee or the personnel office is necessary.

148350 and over. The annualized wage threshold where the annual exemption amount is eliminated has changed from 234750 to 241850. Detailed Rhode Island state income tax rates and brackets are available on this page.

Do not apply to employers in Rhode Island that prior to March 9 2020 were withholding another states income tax from the wages of employees working remotely in that other state Do not apply in situations where the employer and its employees albeit working remotely are situated in the same state.

Tax Tips For Agents Part 2 Tax Deductions Top Mortgage Lenders Tax Write Offs

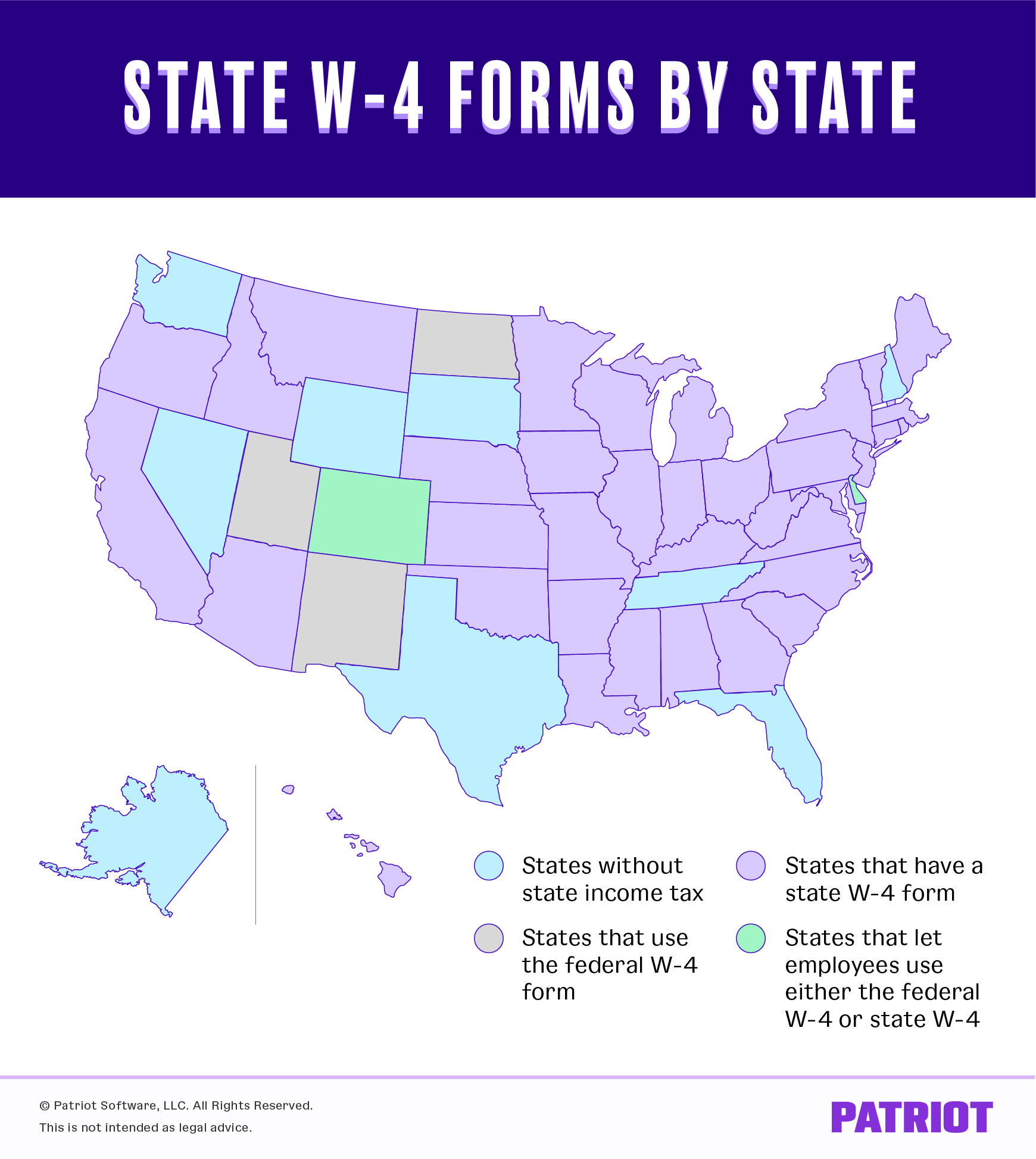

State W 4 Form Detailed Withholding Forms By State Chart

Rhode Island Income Tax Ri State Tax Calculator Community Tax

State W 4 Form Detailed Withholding Forms By State Chart

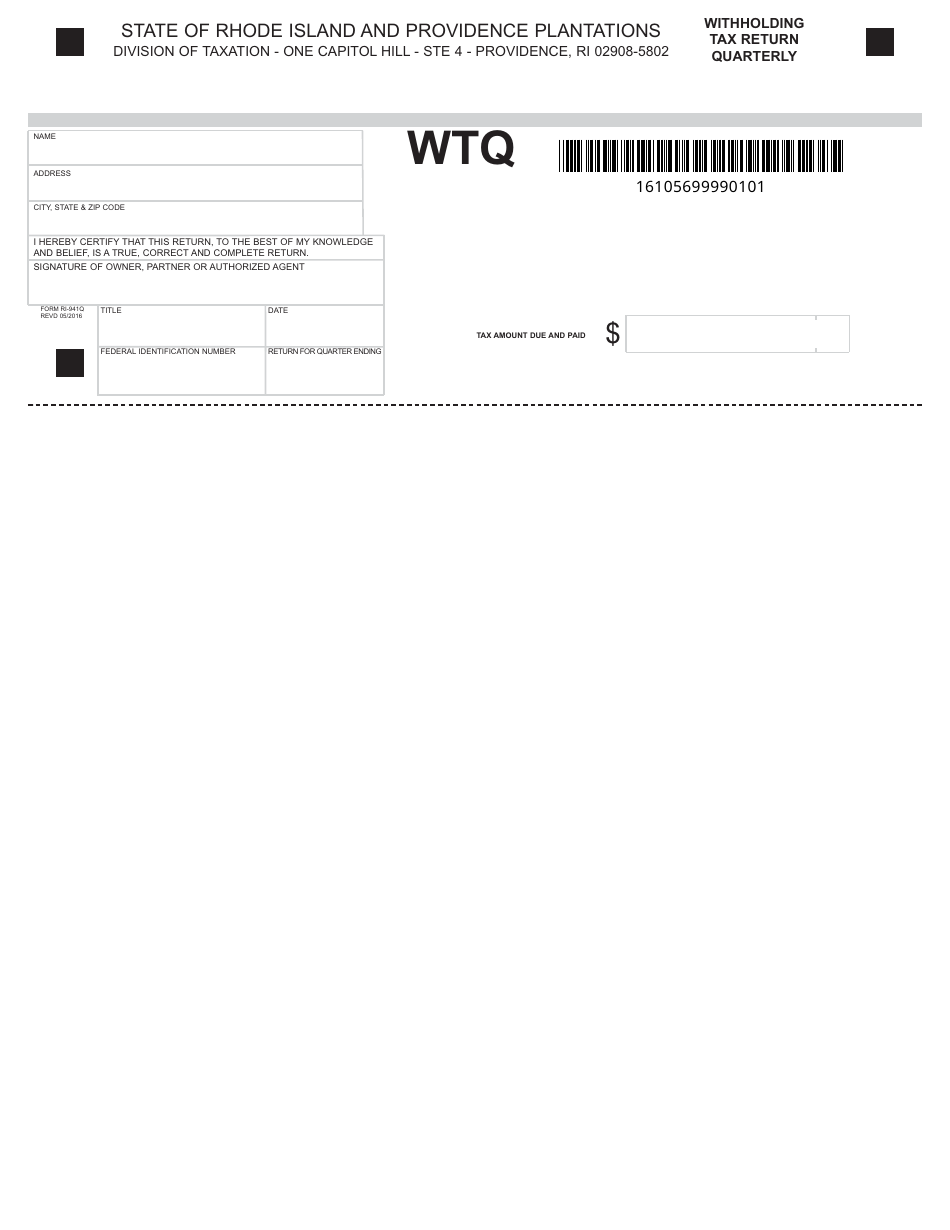

Form Wtq Download Fillable Pdf Or Fill Online Withholding Tax Return Quarterly Rhode Island Templateroller

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Does Your State Have A Corporate Alternative Minimum Tax

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

Powerchurch Software Church Management Software For Today S Growing Churches

Tax Tips For Agents Part 2 Tax Deductions Top Mortgage Lenders Tax Write Offs

State W 4 Form Detailed Withholding Forms By State Chart

Rhode Island Income Tax Ri State Tax Calculator Community Tax

What Are Cvv2 And Cvc2 Numbers Take Care Of Yourself Credit Card Coding

State Income Tax Withholding Considerations A Better Way To Blog Paymaster