sales tax calculator hayward

The December 2020 total local sales tax rate was 9750. Fast Easy Tax Solutions.

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Calculator

Hayward CA Sales Tax Rate.

. You can find more tax rates and allowances for Hayward and California in the 2022 California Tax Tables. How to use Hayward Sales Tax Calculator. MN Sales Tax Rate.

This is the total of state county and city sales tax rates. The Hayward California Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Hayward California in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Hayward California. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Hayward CA.

The minimum combined 2022 sales tax rate for Hayward California is. The current total local sales tax rate in Hayward CA is 10750. The Hayward sales tax rate is.

Hayward Sales Tax Rates for 2022 Hayward in California has a tax rate of 975 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Hayward totaling 225. Download all California sales tax rates by zip code. For tax rates in other cities see California sales taxes by city and county.

The California sales tax rate is currently. Ad Find Out Sales Tax Rates For Free. You can print a 1075 sales tax table here.

The current total local sales tax rate in Hayward MN is 7375. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Hayward CA. The 1075 sales tax rate in Hayward consists of 6 California state sales tax 025 Alameda County sales tax 05 Hayward tax and 4 Special tax.

Sales Tax Amount Net Price x Sales Tax Percentage 100 Total Price Net Price Sales Tax Amount. Check your city tax rate from here Thats it you can now get the tax amount as well as the final amount which includes the tax too Method to calculate Hayward sales tax in 2021. One of a suite of free online calculators provided by the team at iCalculator.

Choose the Sales Tax Rate from the drop-down list. Enter your Amount in the respected text field. The Hayward California sales tax is 975 consisting of 600 California state sales tax and 375 Hayward local sales taxesThe local sales tax consists of a 025 county sales tax a 050 city sales tax and a 300 special district sales tax used to fund transportation districts local attractions etc.

The County sales tax rate is. The December 2020 total local sales tax rate was also 7375.

Townhomes For Sale In Hayward Ca Realtor Com

Minnesota Sales Tax Rates By City County 2022

Percents Sales Tax Tips And Commission Notes Task Cards And Worksheet Money Math Worksheets Money Math Free Printable Math Worksheets

New Tax Regime Tax Slabs Income Tax Income Tax Deductions

Wisconsin Property Tax Calculator Smartasset

Wisconsin Sales Tax Rates By City County 2022

Toyota Certified Used Cars In Hayward Ca Autonation Toyota Hayward

California Vehicle Sales Tax Fees Calculator

How To Use A California Car Sales Tax Calculator

Alameda County Ca Property Tax Calculator Smartasset

Transfer Tax Calculator 2022 For All 50 States

Existing Tax Regime Tax Slabs Income Tax Tax Income

Transfer Tax Alameda County California Who Pays What

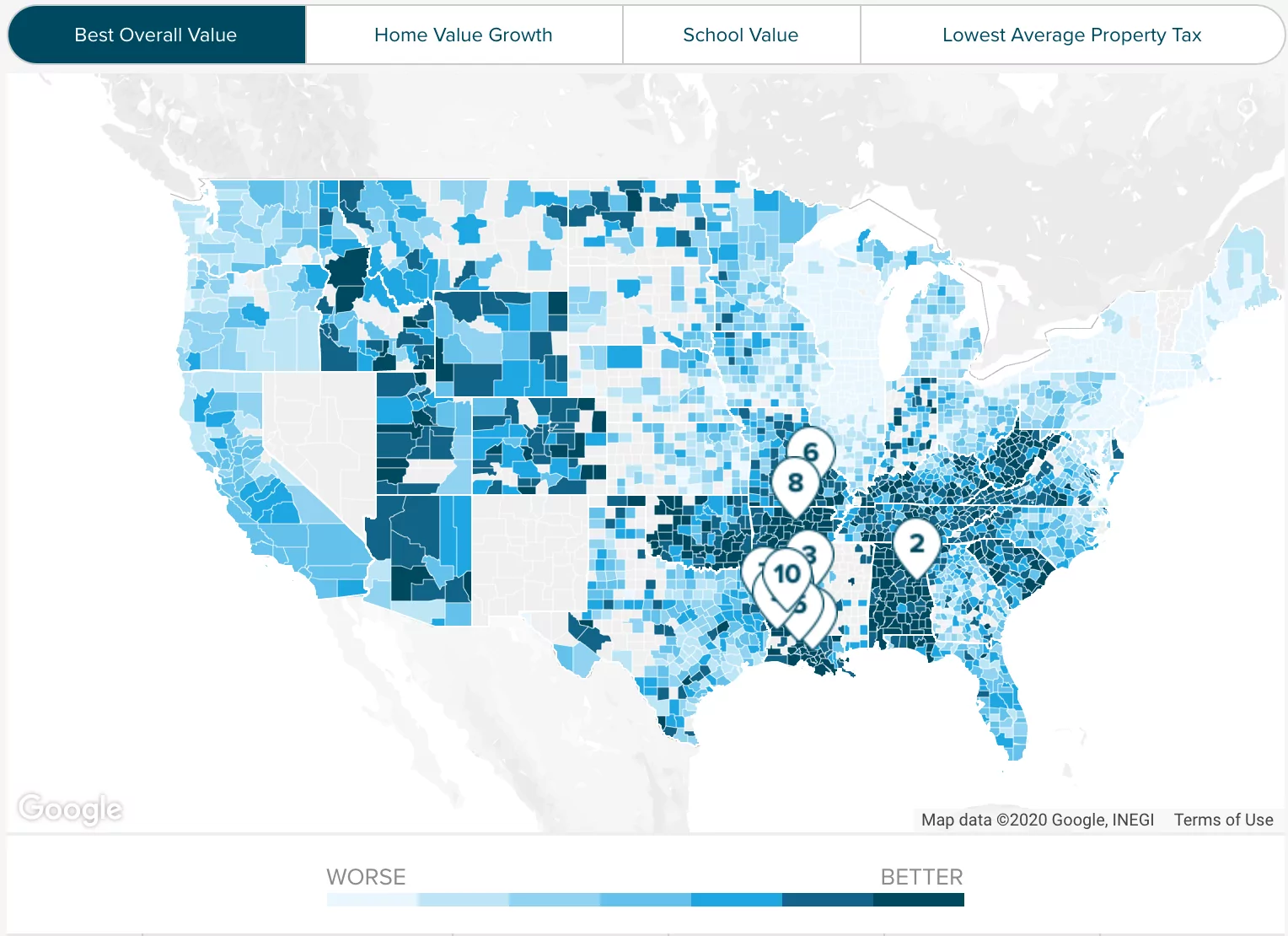

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Is Shipping In California Taxable Taxjar

California Vehicle Sales Tax Fees Calculator

Transfer Tax Alameda County California Who Pays What

/https://s3.amazonaws.com/lmbucket0/media/business/hesperian-a-st-8589-1-rWWSVdidRtE2zRjn691Pyn7fIA7LBWWyJYgYus4O2V4.05034241caa6.jpg)